Amid the growing green energy push unfolding among mostly the Democratic side of the isle in Washington, noted oil majors like ExxonMobil, Chevron, Royal Dutch Shell, BP and others are finding themselves at odds with investors and the public in general that want a greener footprint, while many in that camp think the days of oil and natural gas usage can magically disappear.

The problem with this thinking is that it’s unrealistic. Despite the best intentions of those that “want to save the planet” by revamping the energy sector and even the fabric of American business, the stark reality is that the world needs and will need hydrocarbons for decades to come.

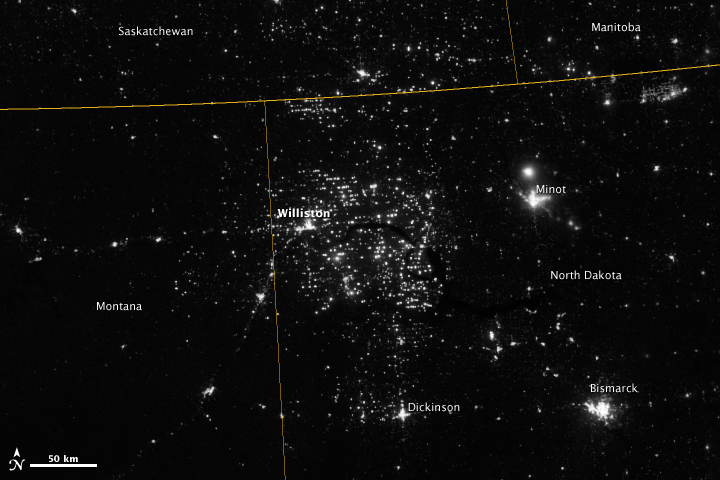

However, the Left is now starting to even demonize the US shale gas sector which has seen remarkable growth, propelling the country to the world’s third largest exporter of liquefied natural gas (LNG), recently bypassing Malaysia. The US could by the mid part of the next decade or even earlier also challenge both Qatar and Australia as the world’s top LNG exporter, bringing in billions of dollars as well as the geopolitical clout that comes from such a development.

Until recently the US gas industry mostly touted the fact that natural gas, though still a fossil fuel, was the cleanest of all hydrocarbons, especially when pitted against coal and oil.

The gas sector is now fending off claims that it needs to be phased out, even though it’s still struggling to offset and replace dirtier burning coal and oil in much of the world for power generation, including the Asia Pacific region, home to around two thirds of the world’s population, where new coal-fired power plants are being commissioned on a regular basis.

Shell CEO Ben van Beurden picked up on this theme yesterday in a Reuters interview. A defiant van Beurden rejected a rising chorus from climate activists and parts of the investor community to transform radically the 112-year-old Anglo-Dutch company’s traditional business model, Reuters reported.

“Despite what a lot of activists say, it is entirely legitimate to invest in oil and gas because the world demands it,” van Beurden said. “We have no choice” but to invest in long-life projects, he added.

Shell is also backing up van Beurden’s rhetoric with action. The oil and gas major plans to greenlight more than 35 new oil and gas projects by 2025. Shell supplied about 3% of the world’s energy last year and is also the world’s largest buyer and seller of LNG.

Van Beurden also made a statement that the climate change activists conveniently ignore when he said a lack of investment in oil and gas projects could lead to a supply shortage and result in price spikes.

In essence, without both oil and natural gas and the various products that are produced from these hydrocarbons, the world economic system would crumble. Perhaps in time, renewables, including wind and solar for power production and electric vehicles for transportation as well as others can represent a major part of the world’s energy infrastructure.

However, that time hasn’t arrived.

The best approach is to use both oil and gas with environmental concerns at the forefront including carbon capture systems, while also allowing the renewables sector the time line it needs to catch up – a point that the political left fails to understand, perhaps best called an “inconvenient truth” that they are ignoring.

“One of the bigger risks is not so much that we will become dinosaurs because we are still investing in oil and gas when there is no need for it anymore. A bigger risk is prematurely turning your back on oil and gas,” van Beurden said.

Keep burning oil and the climate changes so badly that we have a really shitty( economic)future.

ignore climate change and we have a really shitty economic future and the world becomes uninhabitable.

Easy decision, if you are not enamored with the oil industry.

Well, it appears that your programming is complete. Now here are some facts to ponder, although facts do not seem to be important to you. If the planet were to be reduced to zero carbon emissions, life on earth would cease to exist. Period. It is not a poisonous gas as you have been brainwashed to believe. It is a life giving essential element that enables life on this planet to exist. Also, the climate is changing, but not for the reason you have been programmed to believe by your daily dose of CNN. Its not your fault because they do try to keep- this part a secret. There are currently stationed all over the entire globe, machines that control and modify the weather every day and its been going on for decades. Weather is a commodity on Wall street. Droughts and floods and hurricanes etc. are created at the push of a button and is being done whenever the agenda to carbon tax you to death requires it. A little research can go a long way to prevent one from being an ignorant rhetoric spouting parrot. Have a nice day.