Powell speaks. Inflation numbers for January released.

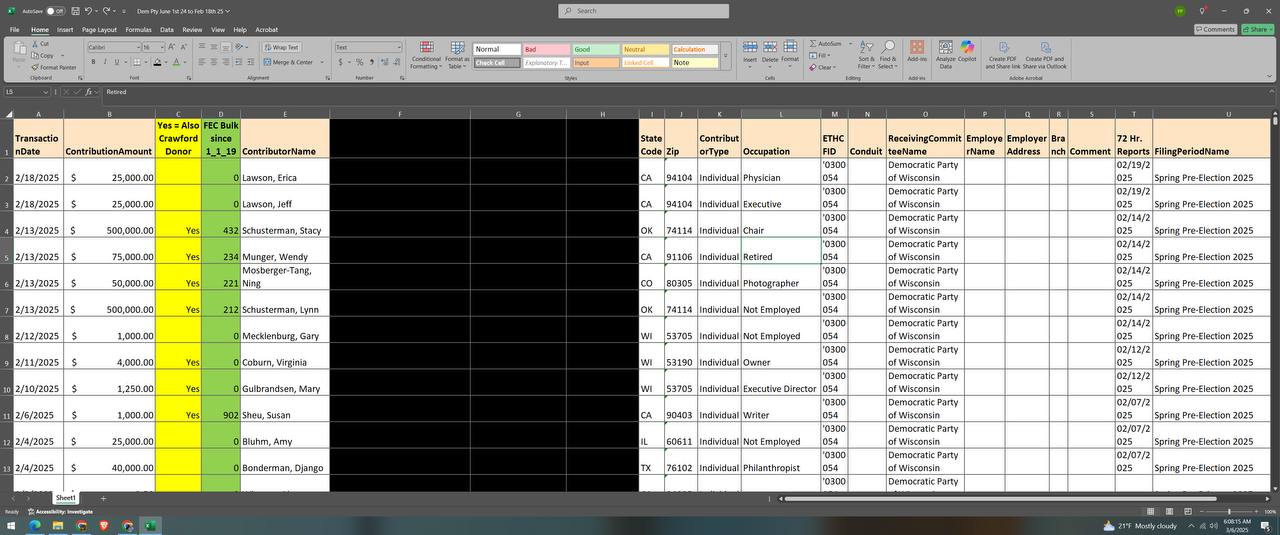

Jerome Powell, head of the FED, was on Capital Hill this week for his semi-annual appearances before the Senate Banking Committee and the House Financial Services Committee on Tuesday and Wednesday respectively. He said that the FED is in no rush to lower interest rates which did not affect gold and silver prices until Friday when they each sold off after reaching highs earlier in the week. I can parrot the analysts by saying profit taking! As I have written before in this space, I want to speak with all those investors taking profits. Either way, the selloff on Friday is another opportunity to get into the metals at advantageous prices. The trend indicators including the 50- and 200-day moving averages continue to point upwards.

The Core Consumer Price Index (CPI) came in above estimates at 3.3 percent over the last 12 months. This is above the FED’s 2% target. The Core Producer Price Index (PPI) for January which measures wholesale prices came in above estimates at 3.4% for the last 12 months also above the FED’s 2% target. This bolsters Powell’s statement about the FED being in no rush to lower interest rates.

Go to our website for a free gold and silver guide, for more information, or to contact me about making a purchase. www.advisormetals.com [email protected] 626 788 5770.