Please Follow us on Gab, Minds, Telegram, Rumble, GETTR, Truth Social, X , Youtube

The FED’s favorite inflation gauge was released this week and…

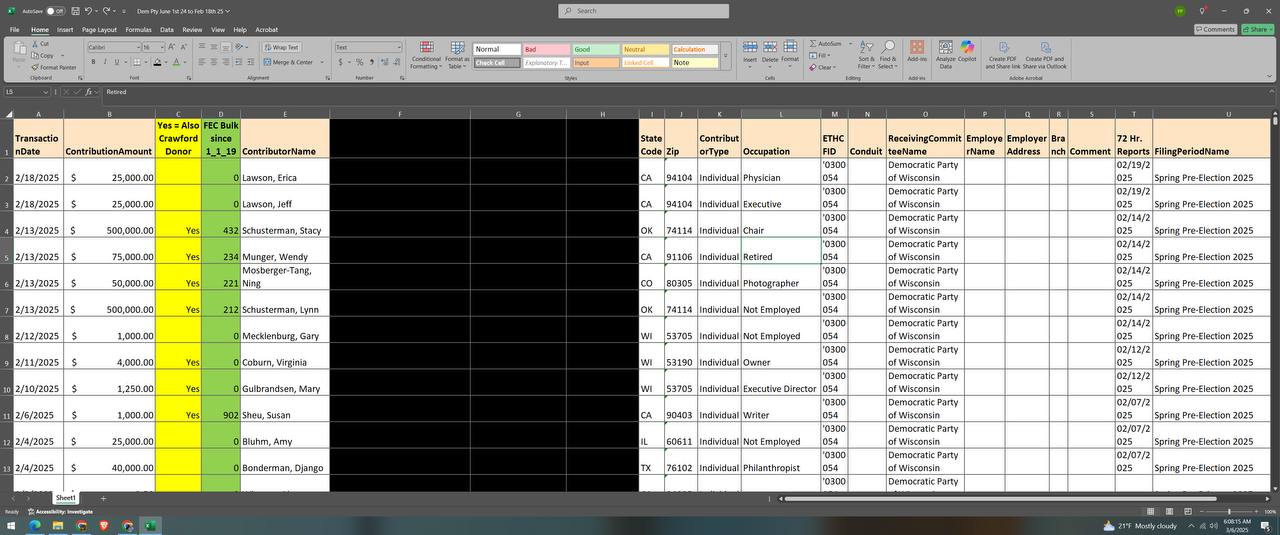

The Personal Consumption Index (PCE) came in a bit hot at a.3% increase for the core (less food and energy) number for January and at an annual rate of 2.6% above the FED’s target of 2% annual inflation. However, the analysts said that famous line that the number was “in line with expectations”. Even though the number was in line with expectations, and as I have written before, an increase in inflation does not bode well for the FED to decrease interest rates. This was negative for the metals and gold and silver both declined on the week.

Personal income was up .9% for the period, above expectations, yet spending declined .2% below expectations. The Federal Reserve Bank of Atlanta, seeing consumers who account for two thirds of the economy beginning to pull back, have forecast negative GDP for the 2025 first quarter.

Gold is up 9.6% year-to-date and silver is up 7.7% year-to date while the Dow Jones Industrial Average (DJIA) is up 1.6%. The metals doing what they do. Hedging economic and market uncertainty.

I am seeing more interest and purchases from my customers, who I always say are the smart money, in light of this economic news. They are hedging and buying dips and momentum when the price moves upward, too.

Go to our website for a free gold and silver guide, for more information, or to contact me about making a purchase. www.advisormetals.com [email protected] 626 788 5770.